Bespoke Alternative Investments

Alternative Investments often comprise the largest portion of institutional investors’ portfolios for a variety of reasons. The most basic premise is that alternative investments can introduce non-market related (idiosyncratic vs. systematic) risk and return elements to a portfolio. We refer to this as ‘constructive’ diversification. The results can be an overall investment portfolio with a more attractive risk to reward profile than a traditional stock and bond portfolio. If that premise is widely adopted by institutional investors, why is it that alternative investments are often underutilized or misused by wealth managers with their high-net-worth clients?

In wealth management, alternative investments are often utilized as products to be ‘sold’ by financial advisors to increase ‘client wallet share’ with little consideration on how the product fits within a client’s investment portfolio or financial plan. Furthermore, many financial advisors, had missteps with alternative investments due to bad timing, luck and often being out of their depth from a knowledge and skill perspective. This has led them to ‘throw up their hands’ and stick to their comfort zone in publicly traded investments.

Zermatt Wealth Partners has deep, real world expertise carefully constructing and managing custom portfolios of institutional quality alternative investments designed to suit the needs of each client. We are fee-based alternative investment advisors and not alternative investment salespeople, an important distinction. We incorporate alternative investments within the context of the broader investment portfolio and in concert with a client’s wealth plan.

Private Investments widely adopted by Institutional Investors

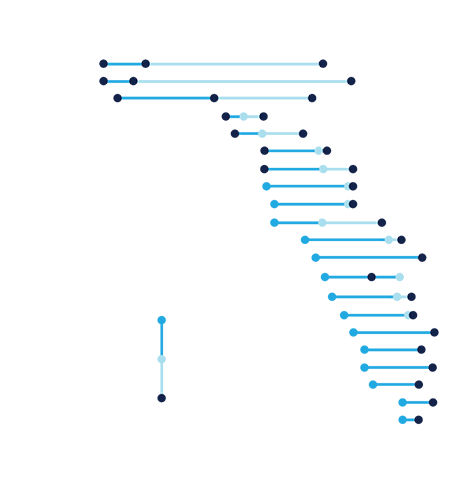

According to latest research conducted by Cambridge Associates, top decile performing institutional investors have increased their private investments allocations to a mean of 40%

Private Investment Allocations

1998

2018

Princeton University

Columbia University

University of Texas

Yale University

Private Investments

Private investments include non-venture private equity, venture capital, distressed securities (private equity structure), private real estate, private oil & gas/natural resources, timber, and other private investments.

Sources: Cambridge Associates Research Report February 2019 Princeton University, University of Texas, Columbia University, Yale News

The importance of Private Market Investing:

What do we mean by Private Market Investments?

A Private Market Investment is any investment into assets that are not currently publicly traded. This includes Private Equity, Credit, and Real Assets, including real estate and infrastructure. In other words, investing in or lending to private companies or assets.

Some reasons why we believe private market investing is an important element to portfolios:

Conclusion: Private markets are displacing the role of public capital markets, especially within the Innovation economy. Private Equity and Private Credit eclipsed $5.25 trillion in Assets under Management in 2020 (per Prequin). Companies no longer need to be public to access capital for growth or liquidity. There is a significant and sophisticated network of private capital available to private businesses of all shapes and sizes.

Over the several years, Zermatt Wealth Partners has developed the requisite and specialized network, relationships, skills, and tools to invest effectively and efficiently into private markets, greatly expanding your investable universe.

Executive and Employee Equity & Stock Option Compensation

Employee Equity Compensation comes in many distinct forms. Regardless of the format, they can be extremely valuable or worthless within the span of a quarter. The main employee compensation vehicles are Incentive Stock Options (ISOs), Non-Qualified Options (NQSOs), Restricted Stock Units (RSUs), and Employee Stock Purchase Plans (ESPPs).

We assist pre-IPO executives and employees in creating liquidity if possible and assist by designing post-liquidity strategies per your objectives tied to a comprehensive financial plan and analytical framework.

For executives and employees of public companies, we assist you to objectively evaluate your concentrated stock scenarios to arrive at a strategy to diversify in a deliberate and intelligent fashion. We also assist in reducing employee ‘proximity’ investor bias with the introduction of cold, hard facts.

An understanding of tax implications is paramount when conducting this analysis, and it is important to involve a specialized 3rd party CPA partner in this analysis when appropriate.

How we help you navigate Employee Equity Compensation scenarios:

Closely Held Business Owner Advisory

Business owners require a differentiated approach to wealth management for a variety of reasons. One key distinction is that much of your wealth is likely concentrated in the enterprise value of your business. Additionally, your business is the largest variable in your wealth accumulation equation. It is crucial to have an aligned wealth management partner who understands the ‘long-game’.

As a wealth management client, we are on your team, which applies to your closely held business interests as well. We support you and your business in the following ways:

Pre-Business Sale Wealth Planning & Analysis

We assist you in arriving at ‘your number’, which is the net proceeds of any business sale required to fund your wealth related dreams and goals. We reverse engineer ‘your number’ through a dynamic financial planning process which identifies your family’s goals and objectives within the context of wealth. We model out post-sale hypotheticals to illustrate your potential cash flows after selling your company.

During the growth and operational phase of your business ownership, we focus on managing your non-business-related assets, family wealth accumulation and your financial plan, so that you can remain laser focused on the growth and management of your business.

Asset location and maximizing tax deferral opportunities (retirement plan and Equity Comp plans) are crucial to diversifying your risks and optimizing post-tax sale proceeds. Well before the exit is defined, these decisions need to be made with flexibility in mind. As a path to exit, whether that be a sale to employees, family generational wealth transfer, a 3rd party sale, or combination thereof, these structures need to be refocused and tightened up to accommodate the most attractive and fluid post-tax sale proceeds.

Equity and non-equity comp via permanent insurance, can be crucial elements in key employee retention. Employee retention is often a significant factor in profitability and valuation. We will assist you in evaluating these options to arrive at the most appropriate structure(s) to suit your needs.

We work with vetted and specialized investment banking teams and transactional attorneys to ensure your business is prepared for an optimized sale with maximum after-tax proceeds. Minimizing transaction costs and maximizing total net proceeds is the objective, and it takes transactional experience to achieve this goal.

We assist in the design and implementation of the structures and processes families use to organize themselves and guide their relationships. When well-designed and properly implemented, family governance can help set boundaries, create clarity, and result in greater harmony between family members, a more focused business, and easier transitions between generations.

Cash is most certainly not king from an inflation perspective. We can develop custom cash management strategies with the goal of optimizing your business’ liquidity. Every basis point counts.

Post-Business Sale Wealth Planning & Analysis

With the increased investible assets resulting from your liquidity event, we shift your portfolio structure to more of an endowment style portfolio, placing a greater emphasis on private equity and real asset investing. We also structure the portfolio to replace the business income you had been living off with alternate investment sources of income, which can include private credit & lending, cash flowing real estate and active muni bond exposure. Our experienced team and systems are well-suited to scale our services in lock step with your liquid wealth accumulation.

Upon the crystallization of your business sale proceeds (turning ‘your number’ from a dream into a reality), we reformulate your wealth plan based off the updated available investible assets and potentially shifting objectives and goals as your perspective has most likely evolved after the sale of your business.

Liability & Insurance Advisory

Insurance needs are identified and addressed via our comprehensive financial planning and business consulting processes. Similar to our investment process, the Zermatt Wealth team is not bound to any insurance product or carrier and the entire insurance toolkit is at our disposal. We leverage various insurance specialists to address more complex insurance needs We believe this framewore enables us to efficiently solve for insurance related wealth planning issues as they are identified through our wealth planning process.

Insurance plays a vital role in wealth planning in four primary areas: