Does Diversification limit your downside risk (chance of loss)

The meaning’s behind overused words or phrases changes with time. The term “diversification” is one in the category. You will get different answers depending on the person you ask. The most common response we hear when asked for a general description of “what does diversification mean?” The most common answer is “Don’t put all your eggs in one basket.” This response is an oversimplification, to say the least.

“Diversification” is the heart of Modern Portfolio Theory, a 1950’s Economic Nobel Prize-winning model.

The goal of this blog is to speak our truth. A long drawn out explanation of Modern Portfolio Theory is a sure way to have you click on something else immediately. If you want to find out more, Google search “Harry Markowitz” or “Modern Portfolio Theory” and your reading options will be endless.

The issue we have with your Google search results are the failures to explain that modern portfolio theory was an academic study to illustrate the variance in expected returns. It was never intended to be the “end all” of portfolio management.

The point of modern portfolio theory was an explanation for the volatility of investment returns that we experience most of the time.

Many of the most well-known economists from the early 1900s to 1950 believed that this was a useful tool in explaining average markets. However, they knew full well that bull and bear markets could cause trouble for Modern Portfolio Theory in its real-world application. After the 2008 & 2009 market crash, the term tail risk was spoken, at nausea around the broader financial world.

Don’t let “tail risk” throw you from what the real discussion is. Tail risk refers to the rates of return that are outside of the model, both positive and negative. Returns on either end of the spectrum, strong positive results or weak negative results, will not be accounted for in modern portfolio theory study.

We will concentrate on bear markets and the potential for loss or Negative Tail Risk. No one complains about positive tail risk. In over 20 years of serving clients, making someone too much money has never been a reason used for my termination papers!

What Is Diversification?

Let us first give you some additional working knowledge beyond “not putting all your eggs in one basket.” Nothing too intense, I promise.

Diversification is not so much a strategy for higher returns as it is a strategy to control risk. Unfortunately for its users, it’s not a very good risk strategy. The great recession of 2008 and 2009 bears that out.

The critical factor in determining risk within Modern Portfolio Theory is the correlation between different investments. (Bear with me. You will need some basic knowledge of correlation if you have not encountered the term before.) Correlation is a calculation which measures the tendency of investments to act similarly. The correlation formula produces results between -1, an opposite relationship exists, to 1, a direct relationship exists.

There are four essential outcomes:

- The investments go up at the same time. (1)

- The investments go down at the same time. (1)

- The investments move in the opposite direction from one another. (-1)

- The investments do not have a relationship, and therefore their movements are independent of each other. (0)

Next, you will need some basic guidelines with the results. A correlation of 0.90 or higher provides very little regarding diversifying away risk. The investments are the same. A calculation producing a result of 0.30 or less is considered attractive pairings for risk diversification within a portfolio. One last one, a result of 0.0, shows No correlation between the investments.

We will not use this information in explaining the widely understood but rarely discussed problems with the assumptions in modern portfolio theory. It is merely a reference point should you do some digging of your own.

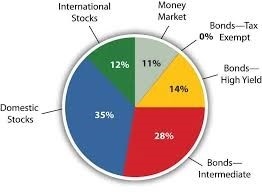

We are concentrating on the application of correlation, not the calculation itself. From the math, one can produce an underlying portfolio that includes a mix of US stocks, International stocks, Bonds, Real Estate and Cash with defined percentages in each category – more commonly referred to as your “Investment Pie Chart.” Some investment companies even embed the chart in your monthly statements.

I know some of you are thinking we left out Alternative Investments, Commodities and Leverage Options. Including “other investment options” will not change the fundamental flaws with portfolios built on diversification strategies.

Model Portfolio Assumptions Sure to Go Wrong

1. People are rational risk-averse investors – The simple goal of investing is to generate more wealth. The underlying assumption is all people correctly evaluate risk using the same information to arrive at the same “rational” decisions.

There is a whole new academic study in the world of economics called Behavior Psychology. The work in this area has been awarded the Nobel Prize two times since the turn of this century. The prize was one for disproving that people are rational when making money decisions. We, humans, are emotional about our money, not rational!

2. Diversification is unaffected by the irrational behavior of a few – This may be true in an “up” market, but it is NOT even close in a “down” market.

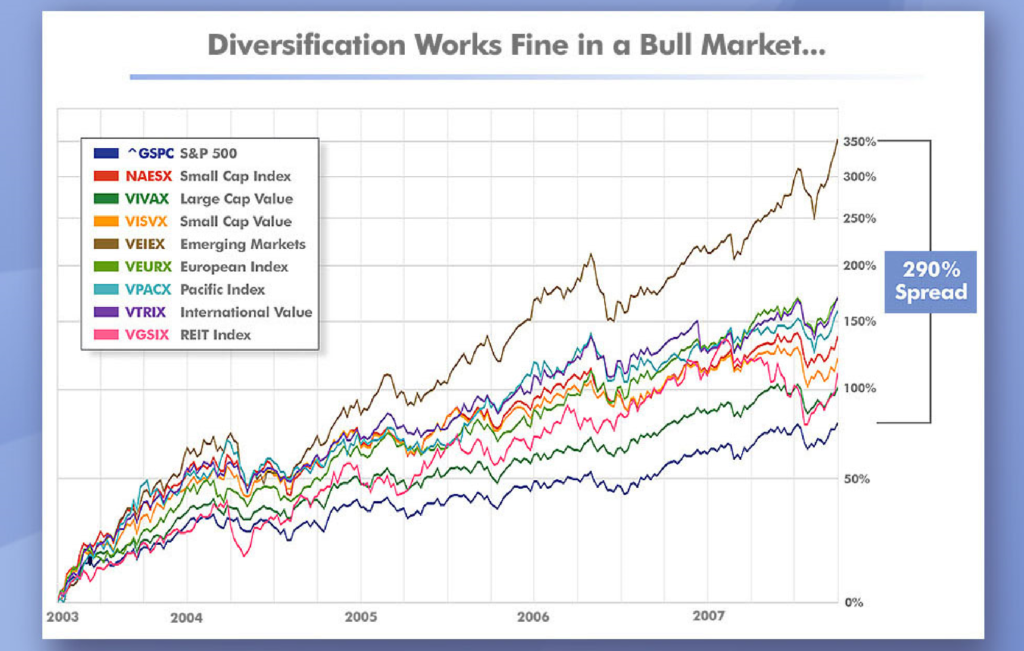

As shown in the graph below, the spread between the returns of some of the best and worst performing stock indexes below is quite significant. A 290% spread from best to worst existed within the bull market running from 2003 through 2007. Since we do not know which investment will be the best or the worst, without the advantage of hindsight; investing some money in each is a sound investment theory to spread your risk around. Diversification at it’s best! Don’t put all your eggs in one basket.

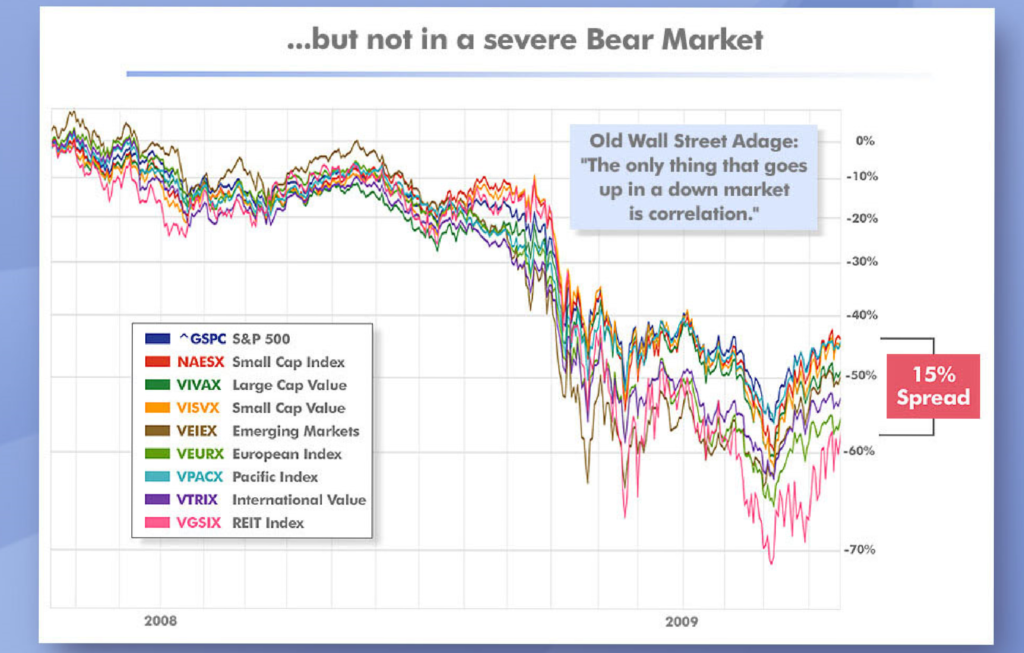

In “down” markets more than an irrational few people head for the exits!

The graph below shows what happened to the same investments in the chart above when the 2008 and 2009 recession occurred. Our 290% spread dropped to a range of 15%. No matter which stock investment you picked, the result was the same – a significant loss! The same problem repeats itself in down markets. Ships sink when the tide goes out!

3. Investment costs and taxes are not relevant – I guess when Harry Markowitz was alive investments were free!

Ok, that statement was a touch passive aggressive. Here is why taxes and investment costs matter – They are not all equal. The higher the taxes and investment cost, the higher the hurdle you must jump for your investment to start making money. Even modern portfolio theorists know this. They try to hide it by using fancy terms to explain it, such as referencing the “upward bias on asset prices.”

If you underestimate the costs, you overestimate the returns, which goes straight to the heart of the theory – producing the best risk-adjusted returns. Higher costs don’t automatically signal lower returns but when does paying more for something help you save money? Are you willing to assume that the higher cost hurdle can be met, year in and year out, for better returns by the investment manager?

The hard part for today’s investor is determining what they are paying. Some costs are listed, and some charges are intentionally left out. Hopefully “real” investment cost transparency is part of the investment landscape in the not too distant future. If you want to know more read our post “9 Reasons to Avoid Mutual Funds – http://www.notiesfinance.com/9-reasons-to-avoid-mutual-funds/

4. No investor is large enough to influence prices – The claim here is that no one can manipulate prices without having some insider information, which if acted on, is illegal.

One of my favorite Warren Buffett stories is the sweetheart of a deal he received from Bank of America to help re-capitalize the bank after the Great Recession of 2008 & 2009. (If you want to know more information, you can Google it.) The gist of the story is that Warren was offered a reduced stock price with a guaranteed dividend to help Bank of America survive the crisis. In the end, Mr. Buffett made $12 Billion on the transaction. He is not the only billionaire getting investment deals that affect stock prices legally. Who says the wealthy do not get preferential treatment?

So Now What?

There is little denying the failures of Asset Allocation. However, we want to restore your confidence in arithmetic with an irrefutable math fact that has a profound effect on your investment returns: The good things help you less than the bad things hurt you!

We remind our clients of this simple math truth whenever possible with the following example –

The Story of Little Billy

Little Billy, our straight-A student, begins with his first grade of the year. Billy does his homework and studies for the first test and gets an A. He does the same things for test #2 and gets the same result, an A. Billy decides that this class is easy, so he stops paying attention, skips the homework assignments and does not study for the exam. The result was Billy’s first F of the year. Billy knows his parents are not going to be happy if he does not get an A on his report card. Little Billy gets back to working hard in school, and when the next test comes, he gets another A. Billy says to himself, thank goodness with three As and one F, I’m an A student again! Is he though? Depending on the actual test scores, Billy’s average now is either a C or B. Why? –

The good things help you less than the bad things hurt you!

It’s not irrational to get out of the market before you lose more than you can afford to lose. That’s common sense! Have you ever determined how much of your money you can afford to lose? It’s an amount everyone should generally understand!

Building Wealth or Staying Wealthy

Diversification combined with Dollar Cost Averaging is a good starting point for Beginning Investors but not the “end all” investment theory applicable to all people and situations.

Most people have a point where they are no longer Okay with portfolio losses. Don’t be shamed into staying invested. If told to “Stay the Course,” it is time for a new advisor.

Some perspective – Five to ten percent market corrections are common. Historically, you can expect one every year. Beyond 10%, you need to know how much you are willing to lose or can afford to lose before the next market drop occurs. This fact can help you save your wealth.

You have predetermined when you will act. If there is a breach of your acceptable loss percentage, you can enact your plan to preserve your wealth.

How about a text message? If one of our client’s account hits its loss amount, the client receives a text message stating that we need to talk so we can determine what actions they want to take. Think about what a difference this could have made in your response to the 2008 – 2009 recession.

No one knows when the next recession is coming, which makes “Stay the Course” even more dangerous. Unless you act now, when the next recession occurs, you will have already lost way more than your acceptable amount. (See Little Billy’s story again.)

Our Motto is: You never have to earn back what you don’t lose!

If you have your nest egg or you are building your nest egg; let us show you a better way to make money, keep money and grow it safely. Reach out to us; we would be glad to share some thoughts around proper risk management.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, www.stocksandnews.com, www.chaikinanalytics.com Chaikin Analytics, www.marketwatch.com, www.BBC.com, www.361capital.com, www.pensionpartners.com, www.cnbc.com, www.FactSet.com, W E Sherman & Co, LLC)

Hayden Royal is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situation are made.

The opinions expressed herein are those of Hayden Royal and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Although taken from reliable sources, Hayden Royal cannot guarantee the accuracy of the information received from third parties.

An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance to certain asset classes. Index performance used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. Their performance does not reflect the expenses associated with the management of an actual portfolio. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. All investing involves risk including loss of principal. Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market. Past performance is no guarantee of future results.